However the world monetary system will change, gold will be among the…

In the attached report, Matterhorn Asset Management advisor and Incrementum AG founder, Ronni Stoeferle, offers a compelling perspective on the rapid changes in the global monetary system and the massive implications behind Western sanctions unleashed on February 27th against Russia.

In the attached report, Matterhorn Asset Management advisor and Incrementum AG founder, Ronni Stoeferle, offers a compelling perspective on the rapid changes in the global monetary system and the massive implications behind Western sanctions unleashed on February 27th against Russia.

As Ronni indicates, these measures have staggering and far-reaching consequences for global markets, currencies and the gold price. ~ Matthew Piepenburg

Continue reading

The standard leftist refrain about “advanced capitalism” is that it amounts to “socialism for the rich and capitalism for the poor.” Like most leftist notions, this idea represents almost the exact opposite of the truth. The system they refer to is anything but socialism for the rich and capitalism for the poor. Capitalists do not want socialism for themselves and capitalism for the rest. Capitalists seek profit, which can only come under a capitalist system.

The standard leftist refrain about “advanced capitalism” is that it amounts to “socialism for the rich and capitalism for the poor.” Like most leftist notions, this idea represents almost the exact opposite of the truth. The system they refer to is anything but socialism for the rich and capitalism for the poor. Capitalists do not want socialism for themselves and capitalism for the rest. Capitalists seek profit, which can only come under a capitalist system.  The United States has borrowed $18 trillion from foreigners since the Great Financial Crisis of 2008, a staggering sum that is nearly equal to America’s annual Gross Domestic Product. The notion that the dollar’s dominance in world finance might come to an end was a fringe view only five years ago, when America’s net foreign investment position was a mere negative $8 trillion. Notably, the net international investment position fell by $6 trillion between 2019 and 2022, roughly the amount of federal stimulus spent in response to the COVID-19 pandemic…

The United States has borrowed $18 trillion from foreigners since the Great Financial Crisis of 2008, a staggering sum that is nearly equal to America’s annual Gross Domestic Product. The notion that the dollar’s dominance in world finance might come to an end was a fringe view only five years ago, when America’s net foreign investment position was a mere negative $8 trillion. Notably, the net international investment position fell by $6 trillion between 2019 and 2022, roughly the amount of federal stimulus spent in response to the COVID-19 pandemic…  Two years after the short, sharp pandemic-related recession, Wall Street is once again warning of a new recession on the horizon.

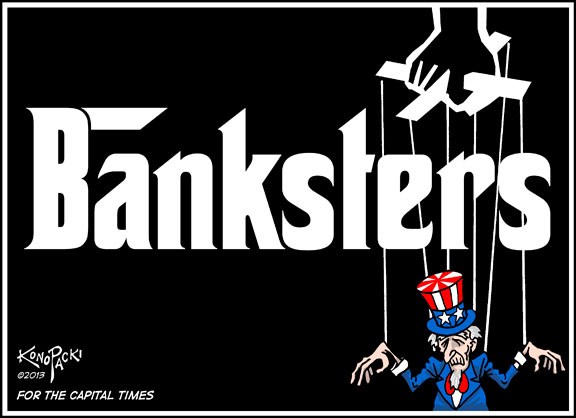

Two years after the short, sharp pandemic-related recession, Wall Street is once again warning of a new recession on the horizon. “I see Bitcoin as the life raft where you don’t have to worry about the Fed’s Ponzi scheme impacting traditional markets or if the economy crashes. You can opt into this parallel system that’s based on the rules that are set,” explained Natalie Brunell, Host of Coin Stories podcast. “When people finally understand Bitcoin, as our financial system unwinds and collapses, hyperbitcoinization will ensue because the dollar is no longer a safe haven.”

“I see Bitcoin as the life raft where you don’t have to worry about the Fed’s Ponzi scheme impacting traditional markets or if the economy crashes. You can opt into this parallel system that’s based on the rules that are set,” explained Natalie Brunell, Host of Coin Stories podcast. “When people finally understand Bitcoin, as our financial system unwinds and collapses, hyperbitcoinization will ensue because the dollar is no longer a safe haven.”  You guessed it: the Russian ruble. After plunging to 139 rubles to the dollar on March 7, the ruble staged a dramatic comeback to around 80 rubles to the dollar. That’s only slightly weaker than where it was for almost all of last year. The recovery is equally impressive when compared with the euro. At the end of February, it took 89 rubles to buy a euro. In early March, that climbed to around 145 rubles. Now it is down to 87.32.

You guessed it: the Russian ruble. After plunging to 139 rubles to the dollar on March 7, the ruble staged a dramatic comeback to around 80 rubles to the dollar. That’s only slightly weaker than where it was for almost all of last year. The recovery is equally impressive when compared with the euro. At the end of February, it took 89 rubles to buy a euro. In early March, that climbed to around 145 rubles. Now it is down to 87.32.  The Biden regime’s foreign policy team is filled with amateurs and half-wits whose heads are filled with Ivy League nonsense about how the world is supposed to work, as evidenced by the administration’s response to Russia’s invasion of Ukraine.

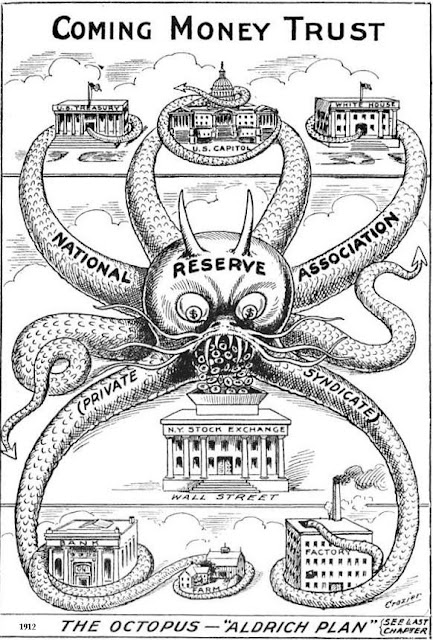

The Biden regime’s foreign policy team is filled with amateurs and half-wits whose heads are filled with Ivy League nonsense about how the world is supposed to work, as evidenced by the administration’s response to Russia’s invasion of Ukraine. Most people believe lending is associated with money. But there is more to lending. A lender lends savings to a borrower as opposed to “just money.” Let us explain.

Most people believe lending is associated with money. But there is more to lending. A lender lends savings to a borrower as opposed to “just money.” Let us explain. I may be wrong, but probably not,

I may be wrong, but probably not,  The government wants your money.

The government wants your money.