The United States government has effectively defaulted on its obligations four times in history.

WTF???

It happened to the Continental Dollar in 1779, the Greenback during the Civil War, the 1934 Liberty Bonds, and Nixon breaking away from the gold standard in 1971. If you count the Greyback, the currency of the Confederacy, that’s five effective defaults… and this starts to look less like an outlier and more like a pattern, complete with economic chaos and civil strife each time. Continue reading

Remember when Democrats proposed in their multi-trillion spendathon that the IRS would track all transactions of $600 or more in personal bank accounts?

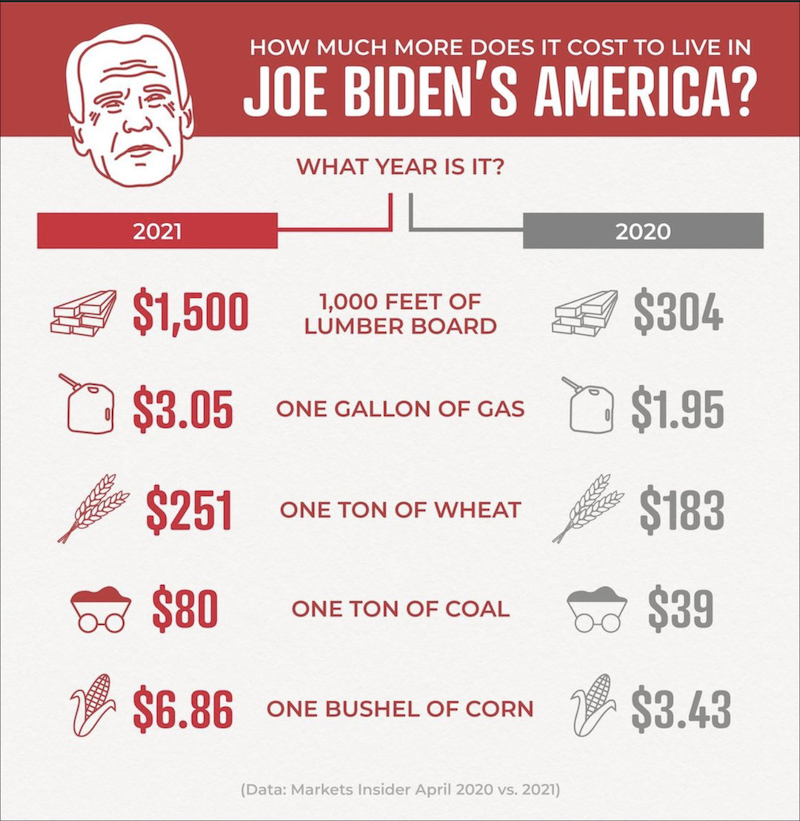

Remember when Democrats proposed in their multi-trillion spendathon that the IRS would track all transactions of $600 or more in personal bank accounts? This week, the Biden administration received just the latest slap in the face from cruel reality: An economic report showing just 194,000 jobs added in the month of September, short of the 500,000 jobs forecast by most economists. The unemployment rate dived to 4.8% from 5.2% – not as a result of job gains, but as a result of more and more Americans dumping out of the work force. Meanwhile, inflation continued to pick up steam, with domestic labor shortages exacerbating supply-chain bottlenecks.

This week, the Biden administration received just the latest slap in the face from cruel reality: An economic report showing just 194,000 jobs added in the month of September, short of the 500,000 jobs forecast by most economists. The unemployment rate dived to 4.8% from 5.2% – not as a result of job gains, but as a result of more and more Americans dumping out of the work force. Meanwhile, inflation continued to pick up steam, with domestic labor shortages exacerbating supply-chain bottlenecks.  For the past year now, I have been writing about the importance of not only avoiding group think and greatly increasing one’s ability to think critically but also of the necessity to get one’s finances in order. These two achievements are inextricably linked and cannot be separated from one another. However, my observations, over the last 18-months, of blind compliance of the masses to tyrannical lockdown mandates issued all over the world, but specifically to tyranny of an elevated nature in the Pacific Rim nations, has convinced me that very few among us, ever spend a single minute per month cultivating the ability to think clearly, reason intellectually, and to formulate conclusions based upon facts. This ability will be essential to financial survival in the next few years.

For the past year now, I have been writing about the importance of not only avoiding group think and greatly increasing one’s ability to think critically but also of the necessity to get one’s finances in order. These two achievements are inextricably linked and cannot be separated from one another. However, my observations, over the last 18-months, of blind compliance of the masses to tyrannical lockdown mandates issued all over the world, but specifically to tyranny of an elevated nature in the Pacific Rim nations, has convinced me that very few among us, ever spend a single minute per month cultivating the ability to think clearly, reason intellectually, and to formulate conclusions based upon facts. This ability will be essential to financial survival in the next few years.

Remarks in Congress: AN ASTOUNDING EXPOSURE

Remarks in Congress: AN ASTOUNDING EXPOSURE