Peace on earth is a wish that gets extra emphasis this time of year. We’re told to pray for it, wish for it, keep it forever in our minds. So why don’t we have it?

Peace on earth is a wish that gets extra emphasis this time of year. We’re told to pray for it, wish for it, keep it forever in our minds. So why don’t we have it?

The short answer is money. War is profitable to some. It’s profitable enough that profiteers in private industries influence government, which stays home and orders others to do the fighting. War costs money. Where does the government get it? Visible taxes (income, corporate, and payroll) cover about two-thirds of government revenue. The rest comes from borrowing and inflation. Continue reading

Do you ever feel… lost? You’re stepping into adulthood. The “real world” is calling. You want to answer the call, but the real world is a real mess.

Do you ever feel… lost? You’re stepping into adulthood. The “real world” is calling. You want to answer the call, but the real world is a real mess. Diversified commodity exposure should continue to perform well in 2025 as a hedge against inflation and economic uncertainty. Specifically, gold and silver are expected to outperform the sector.

Diversified commodity exposure should continue to perform well in 2025 as a hedge against inflation and economic uncertainty. Specifically, gold and silver are expected to outperform the sector. Signs that we were once a truly great nation are all around us. Previous generations of Americans handed us the keys to the most magnificent domestic infrastructure that the world had ever seen, but now it is literally falling apart all around us. Thousands of bridges are structurally deficient and there have already been some very high profile collapses. Hundreds of thousands of miles of highways and roads in the United States are in very poor shape. Aging sewer systems are leaking raw sewage all over the place, and children are being slowly poisoned by lead pipes that desperately need to be replaced. The power grid is hopelessly overloaded and is extremely vulnerable.

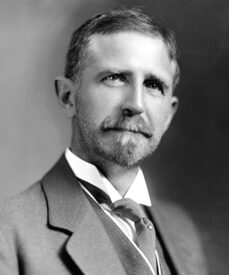

Signs that we were once a truly great nation are all around us. Previous generations of Americans handed us the keys to the most magnificent domestic infrastructure that the world had ever seen, but now it is literally falling apart all around us. Thousands of bridges are structurally deficient and there have already been some very high profile collapses. Hundreds of thousands of miles of highways and roads in the United States are in very poor shape. Aging sewer systems are leaking raw sewage all over the place, and children are being slowly poisoned by lead pipes that desperately need to be replaced. The power grid is hopelessly overloaded and is extremely vulnerable. Some friends and I were discussing Roger Babson earlier today. Several of us have a feeling that the markets may be approaching a critical juncture, and we were wondering how that might express itself, given today’s Fed and government activism as opposed to the more ad hoc to stabilizing markets in Babson’s day.

Some friends and I were discussing Roger Babson earlier today. Several of us have a feeling that the markets may be approaching a critical juncture, and we were wondering how that might express itself, given today’s Fed and government activism as opposed to the more ad hoc to stabilizing markets in Babson’s day.

They have officially ruined breakfast. Once upon a time, breakfast was the least expensive meal of the day, but now everything has changed. Eggs, butter and coffee have all become extremely expensive, and there is no relief in sight in 2025. When I went to the grocery store on Friday, I spent about 45 dollars for just nine tubs of butter. I could hardly believe my eyes, but after doing some digging I discovered that five dollars for a pound of butter is very close to the national average at this stage.

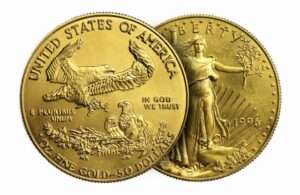

They have officially ruined breakfast. Once upon a time, breakfast was the least expensive meal of the day, but now everything has changed. Eggs, butter and coffee have all become extremely expensive, and there is no relief in sight in 2025. When I went to the grocery store on Friday, I spent about 45 dollars for just nine tubs of butter. I could hardly believe my eyes, but after doing some digging I discovered that five dollars for a pound of butter is very close to the national average at this stage. Gold enthusiasts can celebrate a golden anniversary on New Year’s Eve and simultaneously mark a market manipulation milestone. Fifty years ago, President Gerald R. Ford legalized private gold ownership, allowing Americans once again to stack the regal metal as a wealth-preserving asset and safe haven against monetary inflation and dollar depreciation. Gold futures trading and market meddling also began in the United States a half-century ago.

Gold enthusiasts can celebrate a golden anniversary on New Year’s Eve and simultaneously mark a market manipulation milestone. Fifty years ago, President Gerald R. Ford legalized private gold ownership, allowing Americans once again to stack the regal metal as a wealth-preserving asset and safe haven against monetary inflation and dollar depreciation. Gold futures trading and market meddling also began in the United States a half-century ago.  We have come to accept that we are permanently trapped in an endless cycle of debt and money creation. But the only reason why debt and money grow at an exponential rate is because that is what our system was designed to do. The Federal Reserve and other central banks around the globe were created with a purpose.

We have come to accept that we are permanently trapped in an endless cycle of debt and money creation. But the only reason why debt and money grow at an exponential rate is because that is what our system was designed to do. The Federal Reserve and other central banks around the globe were created with a purpose.