WHY BUY GOLD?

WHY BUY GOLD?

Gold’s value often increases with economic downturns, the devaluation of the U.S. dollar and geopolitical turmoil, making the price of Gold today often worth the investment. Because the global supply is relatively finite, Gold’s purchasing power has historically remained stable during inflationary times. Many consider Gold a safe haven for this very reason and, when reviewing the price of Gold today, buy Gold to balance out their portfolio. Gold is used in many technologies and medical devices, as well as other industrial products, and the demand for Gold jewelry is always high. An ounce of Gold has the same value anywhere in the world, which makes trading the yellow Precious Metal simple and easy.

“Actually, it is difficult to envision in this regard any other criterion, any other standard than Gold. Yes Gold, which does not change in nature, which can be made into either bars, ingots or coins, which as no nationality, which is considered, in all places and all times, the immutable and fiduciary value par excellence.” – Charles de Gaulle

“Actually, it is difficult to envision in this regard any other criterion, any other standard than Gold. Yes Gold, which does not change in nature, which can be made into either bars, ingots or coins, which as no nationality, which is considered, in all places and all times, the immutable and fiduciary value par excellence.” – Charles de Gaulle

The answer to the title question is simply: “Why Not?”

Precious metals will always be the world’s reserve currency. Even though nations do not define their currency by their worth in, say, gold, individuals will still buy gold to protect themselves from inflation. The more money a nation’s central bank pours into the economy, the less valuable its currency (the dollar) is, which means the price of everything else rises. Seeing that the dollar is cheap, many individuals start to distrust the national economy and instead of investing in dollar-making opportunities like business expansion, they will buy gold.

“It is extraordinary how many emotional storms one may weather in safety if one is ballasted with ever so little gold.” – William McFee (1881-1945)

“It is extraordinary how many emotional storms one may weather in safety if one is ballasted with ever so little gold.” – William McFee (1881-1945)

The following series of articles, columns, historical documents and speeches may in fact provide the answers you have been looking for.

The Truth About Money

Most Americans assume the Federal Reserve Bank is a branch of Government. It is not. The Federal Reserve Bank is a private corporation, owned by foreign interests. This bank and its stockholders control the entire wealth of America.

GOLD: A Valuable Thing to Store

GOLD: A Valuable Thing to Store

There is great confusion regarding the value of gold through time, not because gold has changed but because everything else has. There is a market for gold all over the world… the stability of gold’s value through time is in contrast with the stability of government promises, especially concerning the stability of the national currency unit… Politicians lie. Gold muddles through. Central bankers make grandiose promises. Gold muddles through.

“What you know you can’t explain, but you feel it. You’ve felt it your entire life. There’s something wrong with the world. You don’t know what it is, but it’s there, like a splinter in you mind, driving you mad” – Morpheus

![]()

“Gold, Mr. Bond.”

The Power of Gold in Times of Crisis

While physical gold is a well-known safe haven asset which investors flock to in times of market turbulence as a way of protecting their wealth, gold is also the ultimate asset to own and possess in times of crisis and emergency. These crisis situations can range from episodes in which fiat currencies collapse, to times in which gold buys safe passage across international borders, and even to periods in which only gold can bail out and rescue an entire nation. Sometimes gold even ensures self-survival and can literally be the difference between life and death.

The Legend of Jacque Dupré

Take a lesson from the legacy Jacque Dupré left his only heir – the power of inter-generational wealth provision. It remains available – even today!

Gold and Economic Freedom

Gold and Economic Freedom

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.” – Alan Greenspan (1966)

Franklin D. Roosevelt & Gold Confiscation

The Presidential Executive order of April 5, 1933, prohibiting the ownership of gold for Americans in MOST circumstances – but not in all!

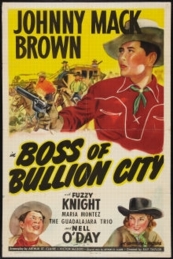

Saint-Gaudens-Double-Eagle-Gold-Coin

Beware: The Ide(a)s of ‘Rare Coin’ Dealers

If you have been considering so-called ‘RARE’ numismatic coins as your main source of ‘holding‘ – then think again… What follows is an expose’ of the Pirates of the precious-metals underworld and how you can truly protect your ass-ets – from them!

Historical Sketch of Paper Currency

“We believe that we are correct in asserting that paper currency is an invention of the eighteenth century, and that all those nations which, since its invention, have had recourse to that fatal panacea, did not, in the end, have any reason to congratulate themselves upon the experiment.” – Hon. C. Gayuarre, Debow’s Review (1877)

~ Gold & Silver in Five Easy Lessons ~

1. Don’t buy it because you need to make money; buy it because you need to protect the money you already have.

1. Don’t buy it because you need to make money; buy it because you need to protect the money you already have.

2. Don’t look at price as a barrier; look at it as an incentive.

3. Don’t buy its paper pretenders; buy the real thing in the form of coins and bullion.

4. Don’t fall prey to glitzy TV ads; do your due diligence instead.

5. Don’t allow naysayers to divert your interest; allow yourself the right to protect your interests as you see fit.

Bullion gold coins will always have value to your fellow Americans, while paper dollars have less and less. As the dollar declines, the price of gold and silver will continue to rise, reflecting the stable purchasing power of the precious metals. What’s more, in a volatile environment, bullion will carry a premium for being reliable and widely accepted money – just as the US dollar does now.

Bullion gold coins will always have value to your fellow Americans, while paper dollars have less and less. As the dollar declines, the price of gold and silver will continue to rise, reflecting the stable purchasing power of the precious metals. What’s more, in a volatile environment, bullion will carry a premium for being reliable and widely accepted money – just as the US dollar does now.

Bullion coins are easy to sell anywhere in the world. And even better, you can barter them locally for the stuff you need – food, clothes, a roof over your head – even if the other guy isn’t a coin enthusiast. In other words, bullion is money.

One of the characteristics that makes gold and silver money is their uniformity – meaning each coin is the same as every other coin of the same weight.

Gold has been prized throughout history for its high value-to-weight, making it easy to conceal and trade under tough political conditions. Consider: you could store enough gold to care for a small family for six months (approx. 9 ounces) on the inside of a belt buckle.

Gold is a commodity. Bullion coins are pre-measured units of this commodity, stamped with a design as a quick signal of authenticity. Gold is also history’s most reliable form of money, which makes it a good commodity to own when the world’s paper money system is in upheaval.

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

602 – 799 – 8214

kettlemoraineltd@cox.net