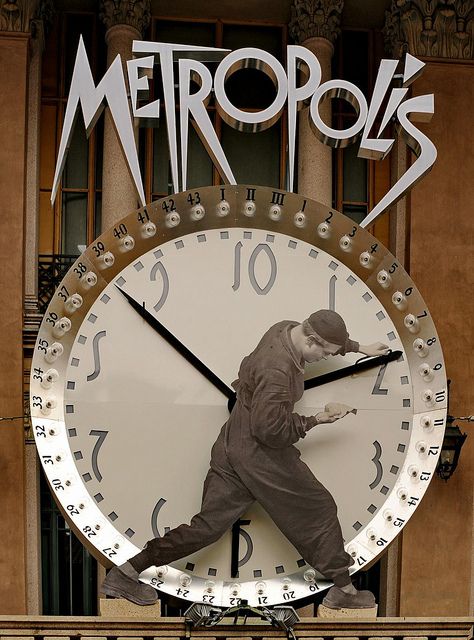

So little time do we have left here on earth and so much is left for us to do.

So little time do we have left…

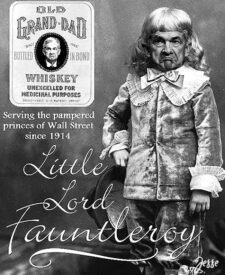

Our nation is in deep shit, and much of it can be traced back to poor morals taught in our homes since the 60s, but it isn’t all to be blamed on the people. The money-changers and monied interests on Wall Street have run one financial scam on the people after another through the whores of the Federal Reserve Bank that has been manufacturing massive economic Bubbles and Busts as a means to steal the wealth of all Americans while enriching themselves. We witnessed the first one in 1929, a mere sixteen years after the federal centralize bank returned to the scene and a group of private bankers was put in charge of our currency and our economy.

Who could have really thought this was good for the average American? Nobody with the sense God gave a goose. President Andrew Jackson knew, and he sent the centralized bank packing with its tail between its legs. The Federal Reserve Bank serves itself first, its criminal cronies and cohorts second, and the American people last.

All of this is tied together, from inflation to the cost of housing to our broken supply chain – still broken in many areas – and a miserable, dying job market, despite all the claims to a “great economy” and the fictitious millions of jobs the Biden regime claims to have created.

I’m no real expert, so my figures might be a bit off the mark, but not by much I’ll wager, for No One Ever Really Gets Ahead. ~ J.O.S.

Inflation by itself has been making affordable single-family homes increasingly difficult to find in any part of America one cares to mention, but the recent labor shortage in the construction industry combined with manufacturing and supply chain problems in the construction materials industry – a result of the Covid Lockdown policies – has compounded the problem beyond belief. Add the politics of zoning demands made by huge developers on local cities and towns, that seek to turn residential areas into commercial zones for a maximum return on their investment, and Americans all across the country find themselves in the middle of one massive housing crisis.

For those developers who temporarily hold onto the houses they are buying, they have raised rents so high that everyone in the family has to work a job. A three bedroom house in Middle Tennessee that rented for $1500 a month just a couple of years ago now demands $2400 a month, and this is a dynamic evolving everywhere. The developers soak the rental for as long as it can, until it convinces a city council to rezone the area to commercial, and then the bulldozers move in to raze the houses to the ground and start construction on the next big idea, an apartment complex, a mall, an Exxon station; city councils have gone so far as to threaten the seizure of private property, when a privately owned piece of property sits on a prime spot and they deem the taxes being paid aren’t sufficient, just as The Grove at the Williams Family Farm in Murfreesboro, TN saw happen to them.

Nothing illuminates the problem so well as the situation that exists in California, where much of the push to place big developments and the bottom line over the real needs of real humans.

Jack and Katarina Murphy [my fictional sample case] bought their first home in 1970. It was a 1260 square foot, nestled in Los Angeles just a block off the San Diego Freeway. They didn’t really realize just how crowded and dirty the area was, until Jack got a job transfer that moved the family to beautiful Portland, Oregon in 1979, at a time when it still had a majority of sane people living there and running the city.

The week they closed escrow on their LA home, they had nine dollars for food until their next paycheck, so they hosted a housewarming party with other family members and friends and asked them to bring lots of cooked food for the party at their home, still unfurnished with only sleeping bags in the bedroom and an old table and vinyl record player in the living room. The leftovers lasted almost two weeks and helped them make it to the next paycheck. And each paycheck thereafter they saved a good portion, built equity in their home and prepared for a family.

A first generation legal immigrant from Yugoslavia, Katarina spoke Serbo-Croatian as her original language, and she was still learning English. She also already spoke Spanish, French and German, so she was having little trouble quickly learning English, and she was looking ahead to a job with one of the major airlines, since she already had seven years experience working for Iberia Airlines out of Frankfurt and Stuttgart, Germany.

Jack was just trying to get used to the idea of being a responsible husband, as he departed with many of his man “toys” and sold his muscle-car, opting for a used 1964 Plymouth Belvedere station wagon as its replacement. He was working hard and trying to save every penny, nickel and dime he could along the way.

They paid $37,750 for their LA home that year. Incredibly, that same home, or one very similar, lists for around $1.33 million, without a single added square foot of interior space or and the same square footage of the surrounding yard – an increase of over 3000 percent in their lifetimes.

In the mid-1990s that same home sold for $230,000. By 2001 it had appreciated to $340,000, and by 2011 $691,000.

That amounts to 100 percent housing inflation on a starter home near the San Diego Freeway in back-to-back decades thanks to the Federal Reserve Bank – our privately owned Central Bank – that controls our currency and our economy. For decades, they have attempted to keep interest rates low and near zero percent, as a way of encouraging growth, but taken to the extremes we have witnessed in recent years and combined with the idiocy of subprime loans to people who never should have been given a loan, it’s been a recipe for economic disaster.

Back in 1970, a mechanical engineer fresh out of college or an airline ticket agent could buy such a house without help from their parents or other family members. But to buy that same home today, they’d have to be married to a cardiac surgeon at UCLA Medical Center, or a top player for a pro-football or basketball team.

Five years later, the Murphy couple sold their home and ended up with an extra $17,250 more — thanks to housing inflation – and they used it as a downpayment on a $75,000 home in the nicer area of Culver City. Ironically, their new home only had eighty more square feet than their starter home. Luckily for them, they made a little extra money from film companies that made a few television series on their street over a few years. And they were even more financially secure with joint earnings that equaled thirty-three percent of the remaining mortgage, and they were only in their late twenties.

They did eventually have children, and by the time their two young daughters, Lara and Ela, were jumping and splashing in the pool, Jack had received a sizeable raise and Katarina was able to quit work without any concerns over child daycare, after-school programs or mortgage payments. The internet, television cable, car charging stations and a bunch of other unnecessary bills didn’t exist in those days, and one’s phone bills were quite affordable.

Fast forward, in today’s housing market, that same home in Culver City would list for close to two million dollars, which means a university professor and a medical doctor with outside moneymakers from YouTube channels, a Substack publication and possibly a porn movie or two in their resume would barely earn enough for a combined income equaling thirty-three percent of the value of a mortgage on that house, depending of course on how good-looking the couple was and how many people the good doctor was willing to kill for Big Pharma.

This same dynamic has been playing out in every state in the union, especially as Californians have moved eastward to escape the insane laws, regulations and taxes that the Democratic Party Communists have imposed at an accelerated rate since 1992. They come to states such as my home state of Tennessee and don’t flinch or waiver on paying the first price thrown out by a hungry, zealous real estate agent, even if that price is 25 or 30 percent above retail market value. In part, this and an ongoing battle to rezone my neighborhood accounts for one house, a block away from mine, selling for $320,000 in 2020 and going on to be sold in 2021 for $330,000 and again in 2023 for $379,000; this last couple seems content to stay put for now, but there’s no telling what this home will sell for the next time around.

This is exactly how the California invasion of Oregon, Washington and several other Western states was engineered. A young person or a couple sells their cracker-jack, rundown three-bedroom [two bath] ranch-style house in San Jose that they inherited from their parents for $1.45 million, and it frees them to buy whatever they want in Nevada, New Mexico, Colorado, Montana and so on. And if they buy in Tennessee, even at an inflated price, they can buy the same house and be left with over a million dollars — regardless of how worthless they may be at the moment, it’s still a million dollars and representative of a lot more wealth than most Americans currently hold in their accounts.

Is it any wonder that California and states everywhere are witnessing a marked rise in homelessness in 2023? To be sure, many are homeless due to drug use or other bad choices, but many others are homeless simply because they aren’t highly qualified enough to demand salaries sufficiently large enough to provide rent money and pay for utilities and groceries and keep themselves and their children properly clothed at the same time.

Minimum wage in Tennessee is still holding firm at $7.25 an hour, and even with both the husband and wife working at this wage, they would be hard pressed to pay the $2400 rent on the house just down the road from me. But as for me, I always negotiated my own rate of pay, and while I have worked for minimum wage in the distant past, I always tried to sharpen, hone and increase my skills to never have to accept so low a wage ever again. It’s also worth noting that some local companies have taken it upon themselves to pay salaries well above minimum wage, although this is also reflected in the price of their products, and combined with the massive stimulus bills of late, it has contributed mightily to the current exorbitant inflation we all face.

And don’t get me started on unconstitutional, illegitimate property taxes. Simply stated, the State never really lets anyone actually own “their” property in this fascist economy that has been stealing Americans’ wealth since 1913, with the advent of the Federal Reserve Bank and the Income Tax.

Americans are witnessing the destruction of the middle class by the Democratic Party Communists and the Biden regime. The destruction manifests itself in several areas, as we see them print money to the point it’s almost Monopoly money, as they continue to spend recklessly and drive up the cost of all goods. Simultaneously, these anti-American rat bastards are flooding America with millions of Illegal Aliens, who are displacing American homeless in shelters, along with Veterans in hotels paid for by NGOs, further shrinking the housing supply everywhere, even in upscale areas.

Americans are witnessing the destruction of the middle class by the Democratic Party Communists and the Biden regime. The destruction manifests itself in several areas, as we see them print money to the point it’s almost Monopoly money, as they continue to spend recklessly and drive up the cost of all goods. Simultaneously, these anti-American rat bastards are flooding America with millions of Illegal Aliens, who are displacing American homeless in shelters, along with Veterans in hotels paid for by NGOs, further shrinking the housing supply everywhere, even in upscale areas.

They’ve killed the energy industry for the time being, as they spend trillions of taxpayer dollars on such useless, worthless idiocies as “carbon credits”, while they continue to export manufacturing jobs by the tens of millions by way of globalization. At the same time, they import millions more of third world tech workers through the H1B1 Visa program, which undermines all American workers.

Wages and income simply cannot and will never keep pace with inflation, so long as we keep going along with the Federal Reserve Bank and their control and manipulations of our economy in what is tantamount to a debt-based economy. Debt is encouraged and promoted by parasitic usury-pimping bankers at every turn in the road along our life’s journey, and everything one cares to mention can currently be bought in installments now, if at a whopping 15 percent annual percentage rate, where one seldom sees a light at the end of the tunnel.

No one ever really gets ahead.

Each generation falls further behind the last one. And it shouldn’t be this way. It need not be this way, if only the American people would wake up, say “NO MORE” and take back their country.

May 21, 2023

Justin O. Smith ~ Author

~ The Author ~

Justin O. Smith has lived in Tennessee off and on most of his adult life, and graduated from Middle Tennessee State University in 1980, with a B.S. and a double major in International Relations and Cultural Geography – minors in Military Science and English, for what its worth. His real education started from that point on. Smith is a frequent contributor to the family of Kettle Moraine Publications.