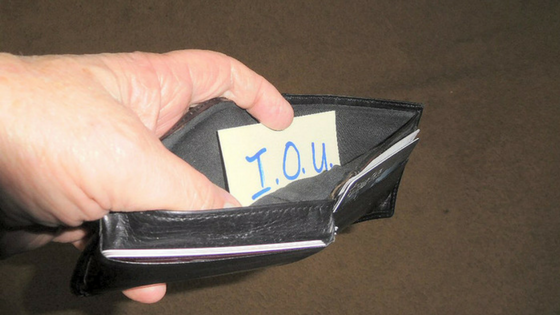

The savings nest eggs that people built up during the COVID-19 pandemic are all but gone, according to new research from the JPMorgan Chase Institute. As savings dwindle, consumers are becoming more vulnerable to financial shocks, which could lead to lower spending and higher debt defaults.

The savings nest eggs that people built up during the COVID-19 pandemic are all but gone, according to new research from the JPMorgan Chase Institute. As savings dwindle, consumers are becoming more vulnerable to financial shocks, which could lead to lower spending and higher debt defaults.

By the numbers: According to the institute’s latest Household Finances Pulse report, the cash reserves of U.S. households have been steadily shrinking since their pandemic-era peak. Here’s a breakdown:

* Most households — except for the lowest-income ones — continue to spend down their savings.

* Although the rate of cash depletion has slowed, savings rates remain negative for middle- and high-income groups.

* Cash balances in June 2024 were only 10% above 2019 levels, compared to historical trends of 20% growth over similar periods.

* Year-over-year balance changes have been negative since mid-2021, though the rate of decline is slowing.

* In June 2024, all racial and ethnic groups had cash balances 3-5% below the prior year.

Morgan the Pirate, Jamie Dimon

Zoom in:

* High-income households are depleting savings at a slower rate but show a flatter trajectory in balance recovery.

* Low-income households have experienced steeper declines but are now decelerating their dissaving more rapidly.

* Black and Hispanic households initially saw greater balance declines but have since converged with Asian and White households in year-over-year changes.

Yes, but… The data may not capture the full picture of household liquidity, as higher interest rates have led some consumers to shift funds to higher-yield accounts not included in the study.

What to watch: Experts predict only a few more months of negative balance growth, but this could push many households below historical cash reserve expectations.

Written by Mike Gibb for Accounts Recovery ~ September 24, 2024