An Analysis of the ‘Rare-Coin’ Industry

An expose’ of the Pirates of the precious-metals underworld and how you can truly protect your ass-ets – from them!

Con Bob the Pirate

While there’s no guarantee on any investment, it is clear we have entered a period of great economic uncertainty. In recent economic news, several banks and major financial institutions have filed for bankruptcy leading our country into what is likely a recession period. The US dollar is losing significant value caused in part by monetary inflation, overspending, and fading market confidence. Some economists speculate that the US will consider a centrally controlled, government issued, cryptocurrency as a means to promote Modern Monetary Theory.

Throughout history, as fiat currencies have come gone, gold has stood the test of time again and again, and there’s reason why… Give Gold a Look in These Uncertain Times

Hjalmar Horace Greeley Schacht

Always and again the magic of money presents us with problems. These problems change constantly. Time after time experience teaches us that there is no universally-valid system by means of which monetary problems may be solved. Every new situation demands new deliberations, new measures, new insights, new ideas. Each of these ideas must be informed by and subservient to the sole and single purpose of maintaining the soundness of the currency. ~ Hjalmar Schacht

Seeking out the most efficient and most secure route to owning gold, and converting it into widely-accepted currency, is the next best thing to enjoying gold-backed currency. In a world of central bankers hell-bent on devaluing your savings you need your own private gold standard.

So… What’s This FUSS About Rare Coins?

If you have been considering so-called ‘RARE’ numismatic coins as your main source of ‘holding‘ – then think again… What follows is an expose’ of the Pirates of the precious-metals underworld and how you can truly protect your ass-ets – from them!

If you are thinking of buying Gold or Silver coins you MUST LISTEN to this Special Program before you buy. The market is filled with nasty surprises… Don’t be caught off guard!

If you are thinking of buying Gold or Silver coins you MUST LISTEN to this Special Program before you buy. The market is filled with nasty surprises… Don’t be caught off guard!

As more investors add gold and silver to their portfolios to protect themselves from a declining dollar and looming inflation, hundreds of companies have sprung up offering dubious and often even dishonest programs for investing in precious metals. These firms confront investors with a bewildering array of murky products, designed mainly to separate inexperienced investors from their hard-earned money.

Using tactics such as bait-and-switch and high-pressure salesmanship, these companies take unfair advantage of the growing enthusiasm for gold and silver by selling products that are poor investments, often containing very little gold or silver, or sold at prices that are many times the value of the coins’ precious metal content.

During this program, we’ll expose all the most common scams so you can buy like a pro. You’ll learn how, like magicians, unscrupulous gold dealers use sleight of hand and fantastic claims to confuse you and make your savings disappear. Armed with this knowledge, you’ll be able to successfully – and profitably – crash proof your portfolio by buying the right kind of gold and silver at a fair price.

BAIT: Suck you in…

BAIT: 1 oz. Gold American Eagle – Current Asking Price: $2,890.00 (01.27.2025)

Let’s get one thing straight: very few gold dealers around today make their living selling bullion coins. They often advertise American Eagles, Canadian Maple Leafs, Australian Kangaroos, etc., at low prices to attract buyers, and sometimes you can actually get them to sell you bullion coins at the advertised prices.

But the reality is that these coins are just used as bait. Most dealers’ goal is to get you on the phone, where their ‘boiler room’ brokers will try several arguments to get you to switch from bullion to rare coins, also known as numismatics.

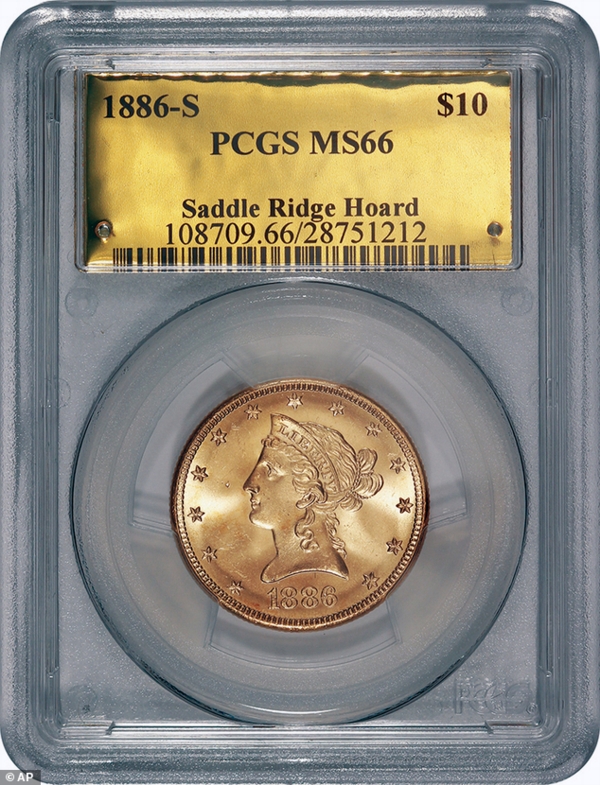

THEIR Goal: Current Asking Price: $39,300.00 (01.27.2025) – Less than a Half Oz.

The first and simplest claim is that rare coins are a better investment on their own merits than plain, old bullion gold. But just like buying an Armani suit is not an investment in wool, numismatics are not an investment in gold. The truth is that rare coins are a speculative – very risky investment, and one that is particularly ill-suited to the next 5-10 years.

But even more sophisticated arguments should be taken with a grain of salt. When dealing with many gold dealers, you have to remember that their brokers are trained to dupe customers. Many firms will hire hundreds of junior brokers and only keep the select few who make the highest commission on each sale. Since bullion coins are a low-margin product, the brokers who sell their customers the best value coins are promptly fired. The ones who excel at deception earn hundreds of thousands of dollars – of your money.

Unless you are a very serious collector who has substantial knowledge of the numismatic world, here are five reasons you should avoid numismatic coins:

The Commissions are EXTREME!

Figure it out fo’ yo’self

So you are watching some radio or TV host you truly admire when the show cuts to commercial. Then, you hear that same reassuring voice urging you to call a “leading” gold company to put away some savings. Once you’re on the phone, the salesman uses that endorsement as evidence that the murky products he’s pushing are legitimate.

Unfortunately, just because a company is endorsed by a well-respected figure does not mean that it is trustworthy. Radio and TV hosts who “endorse” gold dealers are often just paid spokesmen.

Most of the time, these celebrities aren’t checking out the companies they endorse to make sure their listeners are getting a good deal. As most come from a journalistic or political background, they aren’t well-qualified to judge a good deal from a bad one – they just don’t have the experience and financial know-how.

The real tragedy of the physical precious metals industry right now is that the less scrupulous a dealer is, the more likely you are to do business with them. That’s because these firms are raking in record profits at the expense of you, their customers, and using them to fund sweeping TV, radio, and print advertising campaigns – and to pay well-respected radio and television hosts to endorse their products. That way, you become familiar with their brand name, and then someone who shares your political or cultural viewpoint tells you the company is trustworthy. Well, it’s time for a reality check.

For many celebrity hosts, accepting advertising dollars from these questionable gold dealers presents a real conflict of interest. If these dishonest companies weren’t raking in big profits on unsuspecting customers, then they wouldn’t have enough money to bankroll the radio and TV shows. If you were in that position, could you imagine the pressure to ‘look the other way’ when you realize customers are being grossly overcharged?

If you are among the many that bought gold from a celebrity-endorsed company and you think you’re ahead because the price of gold is way up, do yourself a favor and call the company today pretending that you want to sell your coins. You’ll likely be horrified to discover how much money you’ve lost.

If you are among the many that bought gold from a celebrity-endorsed company and you think you’re ahead because the price of gold is way up, do yourself a favor and call the company today pretending that you want to sell your coins. You’ll likely be horrified to discover how much money you’ve lost.

If you’re buying a numismatic coin, you will not be paying a fair price for the bullion contained in the coin. Dealers sell numismatics at prices of 30-50% or more over the coins’ bullion value, and a large chunk of that will simply go into the dealer’s pocket.

A serious collector might buy a truly rare coin for double, triple, or even many multiples of the value of the metal it contains because he values its rarity and/or beauty. But, for the average investor, numismatic coins are on par with stamps or baseball cards.

The GREEDY Coin “Dealer”

Sure, the coins’ metal content will provide a floor to their value that stamps and baseball cards don’t have, but the gold value is typically only a fraction of the retail price of a numismatic coin. If you pay twice the bullion value to buy a rare coin, bullion could double in value and you still might not be able to sell your coin for a profit. If you buy a regular bullion coin, the gold price only has to rise a few points above spot before you profit.

Firms pushing numismatics may say the spread of the coin they’re selling you is only, say, 35%. That means they will buy your coin back for 35% less that you bought it for – NOT so good. But consider this: with a 35% spread, the coin actually must appreciate 55% for you to break even. One firm says that this is okay, because investors should hold coins for 3-5 years. But why would you want to wait 3-5 years just to break even? With that kind of return, you might as well put the money under the mattress.

In short, if you are buying numismatic coins, chances are you’re making a fast-talking salesman very rich at your expense.

They’re HARD to Liquidate

Even if your rare coin does appreciate, good luck trying to sell it. While bullion coins are accepted at near spot price around the world, there is no ready market for numismatics. You could try selling the coins back to your dealer, but chances are he’ll offer much less than what you paid. eBay doesn’t work because the buyer can’t verify that the coin is actually rare. And it’s nearly impossible to sell them to the general public, as you probably don’t have the persuasive power of the fast-talking broker who sold the coins to you.

Even if your rare coin does appreciate, good luck trying to sell it. While bullion coins are accepted at near spot price around the world, there is no ready market for numismatics. You could try selling the coins back to your dealer, but chances are he’ll offer much less than what you paid. eBay doesn’t work because the buyer can’t verify that the coin is actually rare. And it’s nearly impossible to sell them to the general public, as you probably don’t have the persuasive power of the fast-talking broker who sold the coins to you.

Experienced collectors do their trading at coin shows, but a novice investor is sure to get a bad deal there. A few off-hand questions and the coin trader will know that you’re in over your head.

By contrast, bullion coins are easy to sell anywhere in the world. And even better, you can barter them locally for the stuff you need – food, clothes, a roof over your head – even if the other guy isn’t a coin enthusiast. In other words, bullion is money.

One of the characteristics that makes gold and silver money is their uniformity – meaning each coin is the same as every other coin of the same weight. Diamonds, which are not uniform because they vary in clarity, color, etc., are not money. Numismatic coins, which vary in rarity, condition, date of issue, etc., are also not money.

Bullion gold coins will always have value to your fellow Americans, while paper dollars have less and less. As the dollar declines, the price of gold and silver will continue to rise, reflecting the stable purchasing power of the precious metals. What’s more, in a volatile environment, bullion will carry a premium for being reliable and widely accepted money – just as the US dollar does now.

The Charts are COOKED

Numismatics salesmen might show you a chart comparing the performance of rare/numismatic coins against regular/bullion coins. Of course, the chart shows the numismatics performing much better. But these graphs almost always track particular rare coins which are cherry-picked with the benefit of hindsight. For every one rare coin that outperforms, there could be ten that severely under perform. Only afterwards would you know which coin you should have bought.

Numismatics salesmen might show you a chart comparing the performance of rare/numismatic coins against regular/bullion coins. Of course, the chart shows the numismatics performing much better. But these graphs almost always track particular rare coins which are cherry-picked with the benefit of hindsight. For every one rare coin that outperforms, there could be ten that severely under perform. Only afterwards would you know which coin you should have bought.

Comparing the wide index of rare coins issued by the Professional Coin Grading Service (PCGS) or NGC – against the spot price of gold bullion shows that over the past decade, rare coins have appreciated only 36% while bullion gold has appreciated 445%! Numismatics have in fact missed most of the gains of the last decade. And this comparison omits most numismatic dealers’ high markups – which could more than wipe out the meager gains for retail investors.

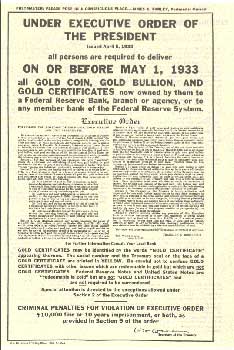

Confiscation is a CON

Some unscrupulous dealers won’t even pretend that numismatics are a better investment (helps avoid lawsuits for fraud), but instead tell customers that only rare coins will be exempt from a coming “gold confiscation.” This is based on a little piece of history taken way out of context.

In 1933, President Roosevelt issued Executive Order 6102, prohibiting the private holding of gold and requiring US citizens to turn over their gold bullion or face a (then) $10,000 fine or 10-years imprisonment.

In 1933, President Roosevelt issued Executive Order 6102, prohibiting the private holding of gold and requiring US citizens to turn over their gold bullion or face a (then) $10,000 fine or 10-years imprisonment.

For private citizens, the order listed the following exemption:

Gold coin and gold certificates in an amount not exceeding in the aggregate $100 [about 5 troy ounces at that time] belonging to any one person; and gold coins having a recognized special value to collectors of rare and unusual coins.

Seizing on this “rare and unusual” language, many coin dealers try to convince unsuspecting customers that regular bullion coins are not safe, but that their rare coins would be exempt from a Roosevelt-style confiscation.

The reality is that almost all coins sold as “numismatic” by these dealers are really quite ordinary coins sold at high markups to make them extra profits. If we were in 1933, the vast majority of these coins would absolutely not fall under the definition of “rare and unusual.”

As mentioned above, true numismatics are extremely rare or one-of-a-kind coins that collectors purchase for their historical and aesthetic qualities. These coins might retail for $25,000 or more, while only containing $2,700 worth of gold. Just like all art isn’t museum art, all old coins are not numismatic. But even if you were buying a genuine rare coin to avoid confiscation, you would be wasting your money – because there isn’t likely to be another confiscation.

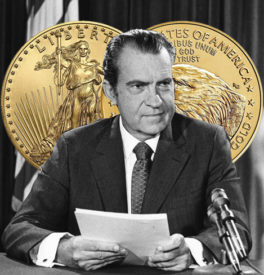

In 1933, when Roosevelt issued his infamous order, the United States was still on a gold standard, meaning every 20.67 paper dollars could have been “redeemed by the bearer on demand” for a troy ounce of gold.

Since Roosevelt had many public works projects to finance and wanted to lower real wages to drive employment, he confiscated gold and then raised the official gold price to $35/oz. Thus, Americans instantly saw a 40% drop in value for the dollars they held.

It’s important to note that confiscation was necessary to Roosevelt’s plan because we were under a gold standard. Gold at that time was widely held throughout the population. If Roosevelt had devalued the dollar without confiscation, then whatever savings Americans held in gold would have been immune from this hidden tax. Furthermore, many Americans likely would have redeemed whatever paper dollars they held in fear of another devaluation. This could have wrecked the dollar’s viability as a currency.

These rationales no longer apply. In the aftermath of Roosevelt’s and Nixon’s dismantling of the gold standard, gold is no longer currency (though it is still money). Most Americans hold their savings in dollars and it is the only legal tender, meaning it must be accepted in payment of all debts. Thus, President Obama and his buddy Bernanke didn’t need to confiscate gold to devalue the dollar and finance excessive spending. In fact, the Fed has more than doubled the monetary base since the financial crisis started – and nothing has changed with Biden nor Trump!

These rationales no longer apply. In the aftermath of Roosevelt’s and Nixon’s dismantling of the gold standard, gold is no longer currency (though it is still money). Most Americans hold their savings in dollars and it is the only legal tender, meaning it must be accepted in payment of all debts. Thus, President Obama and his buddy Bernanke didn’t need to confiscate gold to devalue the dollar and finance excessive spending. In fact, the Fed has more than doubled the monetary base since the financial crisis started – and nothing has changed with Biden nor Trump!

The bottom line is that unscrupulous dealers use the threat of confiscation as a scare tactic to get you to buy gold coins at mark-ups well above the spot value of the metal they contain.

Personal History: I will be seventy-seven in February (2025). When I was ten years old, my grandfather sat me down in a bank vault and gave me quite a lesson in the history of money. On that very day, I began to purchase old silver dollars out of a bag in that bank vault – you could still do that in 1958 – when our money was still real. I paid a paper dollar for a silver Peace dollar (still legal-spendable currency in the country). I asked him why we were doing this, and he said, “Son, one day they will take the silver out of our money in the same manner that that son-of-a-bitch Roosevelt did with our gold in 1933.” Six years later Gramps was proven to be correct.

Personal History: I will be seventy-seven in February (2025). When I was ten years old, my grandfather sat me down in a bank vault and gave me quite a lesson in the history of money. On that very day, I began to purchase old silver dollars out of a bag in that bank vault – you could still do that in 1958 – when our money was still real. I paid a paper dollar for a silver Peace dollar (still legal-spendable currency in the country). I asked him why we were doing this, and he said, “Son, one day they will take the silver out of our money in the same manner that that son-of-a-bitch Roosevelt did with our gold in 1933.” Six years later Gramps was proven to be correct.

My FIRST gold purchase – and I purchased two in 1960. Spot Gold was $36.50 with a net gold weight of .2304 oz. I paid $12.00 per coin. Today, they are worth approximately $650.00 EACH!

By age twelve, he began to take me to coin auctions and estate sales, whereupon I began to purchase a few small, moderate gold coins. As you may recall, few people were allowed to own gold back then – other than in the form of jewelry or coin collections. Many who owned gold coins were still scared to death of the ghost of FDR and his gold-grabbing cohorts – but true coin collectors knew what the rules were and what they could legally own. It was those people, who my grandfather introduced me to – and I have been a collector of specie since that day. Yes, all these years later, I still go to auctions and still purchase collector AND investor grade coins – in gold, silver, nickel and copper. Some I purchase for the same reason you seem to be considering – investment – not so much for myself any longer – but for my granddaughters. It never dawned on me until I was 43, that one could actually make a comfortable living providing both investment grade coins and security to desiring clients and collectors – and 34 years later I am still doing it.

Many of the folks, who you will talk to in this “industry” have been doing it for three years or less – and they are still “selling” you what their bosses want you to buy – a bill of goods. They are all hopping on the bull-market-in-gold train and that is all they know. Enough on that topic.

Consider the following: When building a home, where do you begin? Do you get a bunch of friends to come over on a Saturday afternoon to “raise the barn?” Do you start by putting up the walls first, then the trusses and roof sheathing, etc.? “Oops, baby. We have to have everyone back next Saturday to pour the foundation!” Consider the purchase of gold and silver much like building that new home – you begin with the foundation – 90% junk silver, 1 oz. silver rounds, small, fractional gold coins – all of which could be used for barter and trade.

“C’mon T.C. – Eat it! Eat it!“

The Rules of Thumb: There is an old adage, which says, “You buy silver to sell and gold to hold.” In simple terms, it means that you sell silver when it has made you a killing of a profit (which it will soon do) or when you need to put a bag of groceries on the table (gallon of milk, loaf of bread and a package of hot-dogs). Like your checking account – it is to be used for your “daily loaf of bread.” But gold? You buy it to hold onto – much for the reasons of which Tens of Thousands of listeners approached me in this past 30 years – until they just couldn’t raise enough cash to replace the roof or pay the taxes. Gold should be used like a savings account – a security blanket. Can you eat it? No – but for thousands of years throughout the world – gold (and by extension, silver) can in many cases be used for “barter” or converted into the local currency of choice.

Allow me to address the “financial crisis” portion of a former client’s note: “It’s quite simple, contrary to what you may have been told (and I can fairly well guess by whom) during a financial crisis or collapse of the U.S. Dollar – NO ONE IS GOING TO CARE THAT YOU OWN AN MS-ANYTHING! When our system gets to the point of financial Armageddon – and ALL fiat systems do – all anyone will care about is the weight of the gold – or silver. Rarity and grade will become valueless!!! The only people who will want it will be the robber-barons, who are left – and they’ll want to steal it at cents-on-the-dollar.”

Bullion coins are easy to sell anywhere in the world. And even better, you can barter them locally for the stuff you need – food, clothes, a roof over your head – even if the other guy isn’t a coin enthusiast. In other words, bullion is money.

One of the characteristics that makes gold and silver money is their uniformity – meaning each coin is the same as every other coin of the same weight.

~ Gold & Silver in Five EASY Lessons ~

1. Don’t buy it because you need to make money; buy it because you need to protect the money you already have.

2. Don’t look at price as a barrier; look at it as an incentive.

3. Don’t buy its paper pretenders; buy the real thing in the form of coins and bullion.

4. Don’t fall prey to glitzy TV ads; do your due diligence instead.

5. Don’t allow naysayers to divert your interest; allow yourself the right to protect your interests as you see fit.

[Got physical… close at hand?]

Let’s do something about that…

Contact Kettle Moraine, Ltd. today by calling or texting 602-799-8214 – that’s 602-799-8214 OR by email at [email protected]. Let us help you ‘Protect Your Wealth’ AND your family today. Once again – call or text us at 602-799-8214 – You are already at our website or tuned into our broadcast tonight.

But let us continue with the warnings…

Numismatics are NOT Crash-Proof

But the Fiat ($) has collapsed anyway…

Many people assume that the crash was the credit crunch of October ‘08. They are mistaken. Though forecast the economic events of 2008 were accurate, the ultimate prediction was that these events would set into motion a larger crash to follow. That crash, the one we has been warning about for well over two decades, is a collapse of the international US dollar standard – which has been happening for some time now!

This is the crisis for which the smart money is preparing. The People’s Bank of China, Reserve Bank of India, Goldman Sachs, Barclays Capital, John Paulson, Jim Rogers, and countless other big names are all protecting themselves from a global monetary breakdown by buying gold. But are they doing it with numismatics? Among the big players, the answer is universally “NO!”

If we enter into depression conditions, numismatics may actually drop in value while the gold price rises. As we have mentioned many times over the past 30 years on the air – numismatic coins depend on the demand of collectors. Collectors are folks with plenty of discretionary income. When inflation is eating away savings and the economy is contracting, who are these mystery millionaires that are going to buy your stash of St. Gaudens’ Double Eagles?

Chances are many collectors will also be liquidating their collections as they lose their jobs and their investments go south.

So, even if the stars align and numismatics manage to outperform bullion, you may find that you don’t own any truly numismatic coins – only a bunch of bullion coins sold to you at rare-coin mark-ups.

Numismatic’s are FOOLS’ Gold

In short: the idea of numismatic coins as investments should be put to rest, once and for all.

UHH – Zat GOLD?

Gold is a commodity. Bullion coins are pre-measured units of this commodity, stamped with a design as a quick signal of authenticity. Gold is also history’s most reliable form of money, which makes it a good commodity to own when the world’s paper money system is in upheaval.

The only people who should be buying numismatics are serious and knowledgeable collectors – those who appreciate the coins for their aesthetic value and take pleasure in owning them, and hope they may eventually see a financial reward. Casual investors, hoping to protect their wealth against recession, inflation and sovereign default, should avoid buying numismatic coins.

WHAT’S THE STORY WITH COLLECTIBLE COINS?

What’s worse than buying a rare coin that’s not so rare? Buying a collectible coin that no one wants to collect! Rare coins usually carry at least some value above their bullion content, but coins marketed as “collectible” range from being major ripoffs to virtually worthless.

And then there are PROOF SETS – It’s ALL Packaging!

“Gold, Mr. Bond.”

A common collectible product sold to novice coin buyers is the “proof set.” Many of these sets contain only legal tender coinage, which doesn’t contain any precious metal content at all. Buying a package of uncirculated US coins from 1986 will leave you with an asset worth about 91¢. As before, the pitch is often that these coins have collectible value, but they really have little. Perhaps they may have some value in 100 years, but even that is questionable.

Once you get into buying proof sets of coins, you have moved far away from any investment objective. This is more the realm of buying Beanie Babies in the hope that they’ll appreciate. We all remember how that one turned out.

If a dealer does happen to sell proof sets of genuine bullion coins, they will surely charge a huge mark-up for packaging. The point again is that these coins are generally worth only their weight in gold or silver. They might glimmer, feature an eagle in flight, or come in a thick plastic case, but they are only worth as much as the metal they contain.

In the worst, and most common, case with proof sets, the metal they contain is mostly aluminum, zinc, or another base metal. In that case, the coins are worth virtually nothing.

Playing on Your Heartstrings with Commemoratives

Commemorative coins are the worst of the collectible bunch. They are constantly being pitched on TV commercials and infomercials, right after the plastic solar-powered fan that’s supposed to keep your car cool and before the magic rag that can soak up a 2-liter bottle of soda from the carpet. And just like those products that sound too good to be true, commemoratives are marketed as gold or silver coins at a fraction of the cost of a bullion coin. How do they manage to sell a gold coin for $19.99, plus shipping and handling? Because it is only clad in gold – most of the coin is a base metal.

While these companies are legally obligated to mention that the coins are clad, they will do whatever they can to distract you from that fact. The most common and successful way to do this is to try to give the coin great sentimental value. Thus, we see commemoratives made from gold or silver “recovered from the vaults beneath the Twin Towers after 9/11.”

They might bear the image of the towers or the USS New York, the warship built from Ground Zero steel. This is all part of a strategy to distract you from the fact that the coins are essentially worthless. In fact, one such company recently lost a court case brought by New York State for $2 million in damages for fraud and false advertising.

There are so many tricks and traps out there that we couldn’t fit them all in this program. These Scumbags may claim that only certified coins are “investment grade.” That’s – Uh – ALL B.S.! All new coins are shiny and clean, just like new cars. It’s only when you have a 1969 Corvette in mint condition that the collectible value goes up. Most new bullion coins will never have rarity value because they are so common.

That is a good thing, because you want to own coins that are easily recognized and accepted by a large market of potential buyers. After all, we’re not buying gold and silver hoping to strike it rich in 50 years – but rather to protect our families from a turbulent economy ahead. When it comes time to sell, you want it to be quick, easy, and profitable.

How do You Buy the RIGHT WAY ~ and WITH Confidence?

Buying gold and silver the right way is actually very simple. Most of the challenge is not being pressured into products you don’t understand. Armed with the knowledge of how a purchase is supposed to happen, you’ll be able to avoid the common pitfalls. It’s like driving a car: once you learn how it’s done, it becomes second-nature.

Gold still has a long bull market ahead of it. Every day, the news brings more stories of busted budgets, growing inflation, and increasing taxes and regulation. When the world’s creditor nations turn their backs on the greenback, all those trillions of dollars printed over the last couple of decades will come flooding home. Precious metals are the ark that will carry you through the flood. In this day and age, there is no excuse for not holding some percentage of your portfolio in physical gold and silver.

We hope this presentation is a shortcut in that process, so that you don’t have to learn the hard way what not to do. Armed with this knowledge, you should be confident in telling the reputable dealers from the dishonest ones.

~ Tell ‘em you want Au – not B.S.! ~

This one oz. Gold bar will break cleanly into 10 – 1/10th oz barter-able and tradable bars – for an average of $700.00+ LESS than buying 10, 1/10th oz American Gold Eagle bullion coins.

Do you truly want to stay out of the system? Are you prepared to buy into the biggest scam since the Iraqi Dinar?

If not – then put your money where it belongs – in YOUR possession – not in the hands of an International MLM cartel.

At Kettle Moraine, Ltd. we will provide you with the finest Swiss minted detachable gram sheets of pure 24 karat gold for hundreds of dollars less than so-called privately issued credit cards with elusive Karatbar “gold” backing.

Gold backing? The only gold that I want is in my back pocket – not backed by promises of an operation that even the US Chamber of Commerce is suspect of – giving a rating of C minus.

And don’t forget – for all of your precious metals needs – whether buying or have the need to sell – call Kettle Moraine, Ltd.

And don’t forget – for all of your precious metals needs – whether buying or have the need to sell – call Kettle Moraine, Ltd.

Remember – NO Dinar, NO celery and NO Karats! If you buy from someone else, tell ‘em you want Au – not B.S.! Call Kettle Moraine today at 602-799-8214.

You can’t fix the past, but you can buy smarter in the future…

[Got physical… close at hand?]

Let’s do something about that…

While there’s no guarantee on any investment, it is clear we have entered a period of great economic uncertainty. In recent economic news, several banks and major financial institutions have filed for bankruptcy leading our country into what is likely a recession period. The US dollar is losing significant value caused in part by monetary inflation, overspending, and fading market confidence. Some economists speculate that the US will consider a centrally controlled, government issued, cryptocurrency as a means to promote Modern Monetary Theory.

RELATED: All That Glitters…

Throughout history, as fiat currencies have come gone, gold has stood the test of time again and again, and there’s reason why… Give Gold a Look in These Uncertain Times!

Always and again the magic of money presents us with problems. These problems change constantly. Time after time experience teaches us that there is no universally-valid system by means of which monetary problems may be solved. Every new situation demands new deliberations, new measures, new insights, new ideas. Each of these ideas must be informed by and subservient to the sole and single purpose of maintaining the soundness of the currency. ~ Hjalmar Schacht

Seeking out the most efficient and most secure route to owning gold, and converting it into widely-accepted currency, is the next best thing to enjoying gold-backed currency.

In a world of central bankers hell-bent on devaluing your savings you need your own private gold standard.

Call us!

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

602 – 799 – 8214

[email protected]