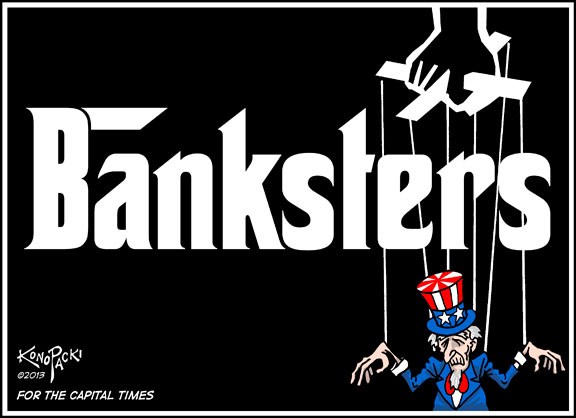

…but they OWN and control the Dollar!

Historically — as during the days of the classical gold standard – central banks maintained stocks of gold to facilitate the conversion of gold-backed national currencies. Those days are long gone, but in modern times, many central banks continue to own gold, and many central banks buy gold as part of their open-market operations. For example, in his article last week – ”Central banks purchase gold to offset their own money destruction“ — Daniel Lacalle writes:

The rising purchases of gold by central banks are an essential factor justifying the recent increase in demand for the precious metal. Central banks, especially in China and India, are trying to reduce their dependence on the dollar or the euro to diversify their reserves.

The US’s central bank, the Federal Reserve, is not among these banks buying gold. Continue reading

If you are surprised by what is happening in the financial world right now, you probably haven’t been paying much attention. Stock prices were obscenely high and many investors were massively over-leveraged. The Dow Jones Industrial Average plummeted by more than 1,000 points on Monday, and stock prices are still obscenely high and many investors are still massively overleveraged. During the days ahead, we are going to see some wild ups and some wild downs, and this tragedy is going to take some time to fully play out. But without a doubt, we have got a major problem on our hands.

If you are surprised by what is happening in the financial world right now, you probably haven’t been paying much attention. Stock prices were obscenely high and many investors were massively over-leveraged. The Dow Jones Industrial Average plummeted by more than 1,000 points on Monday, and stock prices are still obscenely high and many investors are still massively overleveraged. During the days ahead, we are going to see some wild ups and some wild downs, and this tragedy is going to take some time to fully play out. But without a doubt, we have got a major problem on our hands.  Do you believe Donald Trump? He is entirely convinced that if we stay on the path that we are currently on we are heading into a “great depression”, and many believe that he is right on target. Unemployment is rising, manufacturing activity is contracting, bankruptcies are soaring, home sales have fallen to depressingly low levels, the cost of living crisis never seems to end, poverty is soaring and homelessness is at the highest level ever recorded.

Do you believe Donald Trump? He is entirely convinced that if we stay on the path that we are currently on we are heading into a “great depression”, and many believe that he is right on target. Unemployment is rising, manufacturing activity is contracting, bankruptcies are soaring, home sales have fallen to depressingly low levels, the cost of living crisis never seems to end, poverty is soaring and homelessness is at the highest level ever recorded.

That two-by-four upside our country’s head you’ve been waiting to get whomped with? Looks like it’s landing now. We got a banger in 2008, but it didn’t make an much of an impression. Maybe you don’t even remember these people, but then Treasury Secretary Hank Paulson and Fed Chair Ben Bernanke came in like a code blue squad and hooked up the banks to an IV-drip speedball of cocaine and heroin, i.e., “money” that didn’t actually exist (a.k.a. “liquidity,” hallucinated capital), and that crew kept it coming for years.

That two-by-four upside our country’s head you’ve been waiting to get whomped with? Looks like it’s landing now. We got a banger in 2008, but it didn’t make an much of an impression. Maybe you don’t even remember these people, but then Treasury Secretary Hank Paulson and Fed Chair Ben Bernanke came in like a code blue squad and hooked up the banks to an IV-drip speedball of cocaine and heroin, i.e., “money” that didn’t actually exist (a.k.a. “liquidity,” hallucinated capital), and that crew kept it coming for years.  For a long time, there was a lot of denial about the direction that the U.S. economy was heading. The Biden administration and the mainstream media just kept insisting that everything was just fine even though everyone could clearly see that it wasn’t. But now reality is setting in. Last week we got some numbers that Wall Street really didn’t like, and a massive temper tantrum ensued.

For a long time, there was a lot of denial about the direction that the U.S. economy was heading. The Biden administration and the mainstream media just kept insisting that everything was just fine even though everyone could clearly see that it wasn’t. But now reality is setting in. Last week we got some numbers that Wall Street really didn’t like, and a massive temper tantrum ensued. Money is supposed to be representative of all the goods and services that the country has produced in an entire year.

Money is supposed to be representative of all the goods and services that the country has produced in an entire year. February 24, 2011 – Nothing seems to arouse passions – pro and con – quite like suggestions that gold should once again play a role in our money. “Only gold is money,” says one side. “It’s a barbarous relic,” says the other. Let’s turn down the heat a bit and look into some propositions about gold. That should lead us to some reasonable ideas about whether or how gold might return.

February 24, 2011 – Nothing seems to arouse passions – pro and con – quite like suggestions that gold should once again play a role in our money. “Only gold is money,” says one side. “It’s a barbarous relic,” says the other. Let’s turn down the heat a bit and look into some propositions about gold. That should lead us to some reasonable ideas about whether or how gold might return.  In discussing the Mises Institute’s June 24th full-page Wall Street Journal ad entitled “Who Needs the Fed?” on talk radio recently most of the interviewers naturally expressed skepticism over whether the Fed could ever actually be abolished and a gold-and-silver standard reinstituted. It reminded me of something Murray Rothbard said about this. If the government had monopolized say, shoe production a hundred years ago and someone suggested the privatization of shoe production, there would be cries of: “Who will make shoes? The government has always made shoes!”

In discussing the Mises Institute’s June 24th full-page Wall Street Journal ad entitled “Who Needs the Fed?” on talk radio recently most of the interviewers naturally expressed skepticism over whether the Fed could ever actually be abolished and a gold-and-silver standard reinstituted. It reminded me of something Murray Rothbard said about this. If the government had monopolized say, shoe production a hundred years ago and someone suggested the privatization of shoe production, there would be cries of: “Who will make shoes? The government has always made shoes!” Do you remember how painful the Great Recession was? 2008 and the years immediately following were definitely a very dark chapter in our history, but a new study has actually found that the percentage of Americans that worry they won’t be able to pay their bills is actually higher today than it was back then.

Do you remember how painful the Great Recession was? 2008 and the years immediately following were definitely a very dark chapter in our history, but a new study has actually found that the percentage of Americans that worry they won’t be able to pay their bills is actually higher today than it was back then.