Fraud Costing U.S. Government Hundreds of Billions a Year as Crime Rings Use Stolen Identities

Fraud Costing U.S. Government Hundreds of Billions a Year as Crime Rings Use Stolen Identities

It’s the most popular f-word in Washington: fraud.

And DOGE — the Trump administration’s Department of Government Efficiency — has been tearing through federal agencies on the hunt for it.

But is DOGE looking in the right places?

The fraud we’ll tell you about tonight is complex, pervasive and being carried out by transnational criminal organizations often using stolen identities to target U.S. taxpayers – costing the government hundreds of billions of dollars a … (Continue to full article)

Millions of Drivers Will Be Forced to Pay Extra for Every Gallon of Gas in 2026 as Cost Jumps 75%

Millions of Drivers Will Be Forced to Pay Extra for Every Gallon of Gas in 2026 as Cost Jumps 75%

DRIVERS are being warned to brace for a brutal gas hike that could leave them shelling out more than $8 for every gallon.

A new report predicts a staggering 75% spike in prices by the end of 2026, hitting wallets across one state in particular.

The report centers on California, where the upcoming closure of two major oil refineries is expected to slash fuel production… (Continue to full article)

U.S. Economy Shows Signs of Trouble With 30 Percent Chance of Recession in 2025

U.S. Economy Shows Signs of Trouble With 30 Percent Chance of Recession in 2025

A new forecast from Beacon Economics warns that the U.S. economy, though not currently in a recession, is showing signs of trouble, particularly as structural imbalances intensify.

Based in Los Angeles, the firm now places the chance of a recession in 2025 at 30%—its highest estimate since the pandemic, though still below the Wall Street Journal’s average of 45%.

Christopher Thornberg, founding partner at Beacon Economics, said the risks stem largely from mounting federal deficits and erratic policy shifts under President Trump’s second term. The report stresses that if the dollar weakens, interest rate hikes may follow, potentially triggering default-level fiscal instability… (Continue to full article)

‘Time Is Running Out‘: Ex-Trump Official Gives Grim Prediction of ‘Unnecessary Recession‘

‘Time Is Running Out‘: Ex-Trump Official Gives Grim Prediction of ‘Unnecessary Recession‘

If Trump isn’t careful, he’s going to open up the United States to an “unnecessary recession” very soon, according to a former Trump official

Trump thinks he has a handle on the trade wars the U.S. is fighting, but things will turn quickly, according to his previous white house communications chief.

Anthony Scaramucci, who previously said Trump was a grifter who “really wants to hurt people… (Continue to full article)

Trump to Unveil Medicare Drug Pricing Plan After Teasing “Earth-Shattering” Announcement

Trump to Unveil Medicare Drug Pricing Plan After Teasing “Earth-Shattering” Announcement

The big announcement that President Trump teased earlier this week in the Oval Office is a “most favored nation” plan to cut Medicare drug prices, sources told CBS News.

The Trump administration previously sought to implement the “most favored nation” idea during Mr. Trump’s first term, tying some high-cost Medicare drugs administered by health care providers to “the lowest price that drug manufacturers receive in other countries.”

Trump said in the Oval Office on Tuesday that in the coming days, he’d reveal “a truly earth-shattering and positive development for this country and for the people of this country… (Continue to full article)

“Gold, Mr. Bond.”

In Gold We Trust? Ex-Trump Economic Advisor Makes the Case for a Dollar Reset

Market uncertainty doesn’t phase Judy Shelton, the former Treasury Department lead advisor for the first Trump administration transition.

The monetary economist has taken a bullish stance when it comes to a “dependable” U.S. dollar and the rising price of gold – and offers a unique pitch to ensure their fiscal stability.

“I’m skeptical when people doubt the future of the dollar or the role of U.S. currency as a world’s dominant reserve currency. I think the dollar has a great future ahead of it.”… (Continue to full article)

America’s Trading Partners Have a Massive Bazooka in the Trade War. They May Never Use It

America’s Trading Partners Have a Massive Bazooka in the Trade War. They May Never Use It

One of America’s closest allies recently raised eyebrows for threatening to fire off the ultimate financial weapon against Washington in trade talks: dumping US debt.

Japanese Finance Minister Katsunobu Kato, whose country is the biggest holder of US Treasuries, said on Friday that selling the assets is a “card on the table” in tariff negotiations

If the tariffs are fully implemented, the US will need to sell its future debt… at lower prices and higher yields.” “More tax cuts, instead of helping offset some of the negative effects of tariffs, will add to the debt at a time when it will become more costly to do so… (Continue to full article)

Hikers Find Gold Coins and Jewelry Worth $341,000 in an Overgrown Field – Could It Be Treasure Hidden From Invading Nazi Forces?

Hikers Find Gold Coins and Jewelry Worth $341,000 in an Overgrown Field – Could It Be Treasure Hidden From Invading Nazi Forces?

It seems it’s not just trail hazards and waymarkers you should keep your eyes peeled for on your hikes abroad: two walkers in the Czech Republic have made an incredible discovery while taking a short cut in a wooded area of the Podkrkonosí Mountains.

After spotting an aluminum can protruding from a stone wall they inspected closer, only to find it, and a metal box nearby, full of coins, ornate jewelry and cigarette cases – all made from precious metals..

The male hikers took the hoard, said to be worth more than $340,000, to the Museum of Eastern Bohemia in Hradec Králové where head of archaeology Miroslav Novak was staggered at the find… (Continue to full article)

Terrifying Social Security Warning Made by Economist Who Predicts Major Cuts

Terrifying Social Security Warning Made by Economist Who Predicts Major Cuts

One economist is sounding the alarm on social security, warning that the money supply, which provides a cushion for those retired Americans, could dry up in a decade. According to FlaglerLive, the retirement and disability program has been running a cash-flow deficit since 2010.

While it currently sits at $2.7 trillion, Dennis W. Jansen has warned that the reserves are diminishing as the number of Americans getting benefits grows. According to Jansen, both of its trust funds would be completely drained by 2035… (Continue to full article)

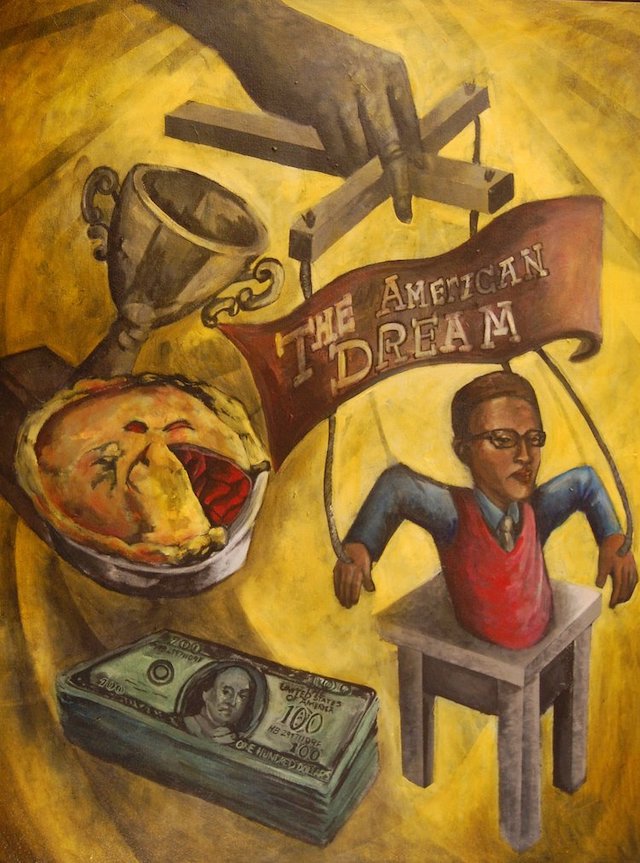

Over the last several decades, the global economy has become more interconnected than ever, but now everything is changing. The flow of goods between the number one economic power on the planet and the number two economic power on the planet is absolutely imploding, and that is going to have enormous implications on both sides of the Pacific. I have written quite a bit about the dramatic decline of U.S. imports, but the numbers show that U.S. exports are falling precipitously as well.

Over the last several decades, the global economy has become more interconnected than ever, but now everything is changing. The flow of goods between the number one economic power on the planet and the number two economic power on the planet is absolutely imploding, and that is going to have enormous implications on both sides of the Pacific. I have written quite a bit about the dramatic decline of U.S. imports, but the numbers show that U.S. exports are falling precipitously as well. For years, our economy and our financial markets have been artificially propped up. Since 2008, politicians in Washington have added about 26 trillion dollars to the national debt, and bureaucrats at the Fed have pumped trillions of freshly created dollars into the financial system. If we could go back and undo just those two things, we would be living an economic horror show right now.

For years, our economy and our financial markets have been artificially propped up. Since 2008, politicians in Washington have added about 26 trillion dollars to the national debt, and bureaucrats at the Fed have pumped trillions of freshly created dollars into the financial system. If we could go back and undo just those two things, we would be living an economic horror show right now.

The value of a dollar shouldn’t require much math. If you have $1, you have $1, right?

The value of a dollar shouldn’t require much math. If you have $1, you have $1, right? I bought the exact same lunch items for my granddaughter this week – same store, same brands, no special sales last week. Total? Up $10 just a few days ago, from $35 to $45. No bulk buys, no extras, just the usual stuff. How does this even happen?

I bought the exact same lunch items for my granddaughter this week – same store, same brands, no special sales last week. Total? Up $10 just a few days ago, from $35 to $45. No bulk buys, no extras, just the usual stuff. How does this even happen? China is normally the largest export market for U.S. agricultural products. In a typical year, we sell tens of billions of dollars worth of agricultural products to the Chinese, but now that door has been slammed shut thanks to the extremely high tariffs that China has imposed on U.S. imports. If that door is not reopened very soon, farmers all over the nation will be facing financial ruin due to massive financial losses that are already piling up. This is not a crisis that may or may not arrive someday –

China is normally the largest export market for U.S. agricultural products. In a typical year, we sell tens of billions of dollars worth of agricultural products to the Chinese, but now that door has been slammed shut thanks to the extremely high tariffs that China has imposed on U.S. imports. If that door is not reopened very soon, farmers all over the nation will be facing financial ruin due to massive financial losses that are already piling up. This is not a crisis that may or may not arrive someday –  Silver has struggled to make meaningful gains despite gold’s sustained rally to fresh all-time highs. But while trade tariffs have muddied the waters and some correlations appear broken, some analysts still see the gray metal making big gains in the coming months.

Silver has struggled to make meaningful gains despite gold’s sustained rally to fresh all-time highs. But while trade tariffs have muddied the waters and some correlations appear broken, some analysts still see the gray metal making big gains in the coming months.