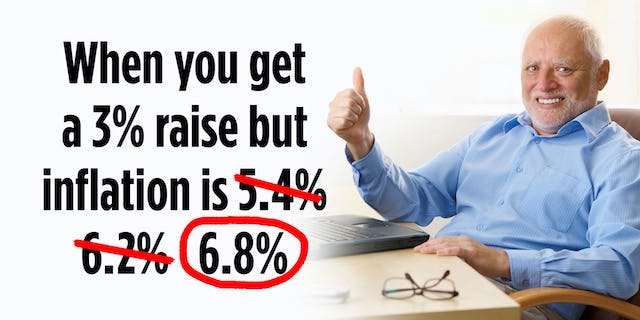

What would our country look like if an epic market crash suddenly wiped out 35 trillion dollars in financial wealth? You may not want to think about something so horrible, but we are being warned that it could soon happen. Stock prices have been falling for three weeks in a row, and last week was the worst week for U.S. stocks in a really, really long time. The S&P 500 is now down more than 8 percent from the peak of the market, and the tech-heavy Nasdaq is already in correction territory. At this point, the Nasdaq is off to its worst beginning to a year in decades, and many are extremely concerned about what is coming next. In fact, Bank of America is warning that all hell breaks loose if the Nasdaq closes below 14,000.

Hopefully that won’t happen this week.

But it might. Continue reading

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly performance-related terms, but also from a big picture perspective.

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly performance-related terms, but also from a big picture perspective.

By the end of 1925, Montagu Norman and the British Establishment were seemingly monarch of all they surveyed. Backed by Strong and the Morgans, the British had had everything their way: they had saddled the world with a new form of pseudo gold standard, with other nations pyramiding money and credit on top of British sterling, while the United States, though still on a gold-coin standard, was ready to help Britain avoid suffering the consequences of abandoning the discipline of the classical gold standard.

By the end of 1925, Montagu Norman and the British Establishment were seemingly monarch of all they surveyed. Backed by Strong and the Morgans, the British had had everything their way: they had saddled the world with a new form of pseudo gold standard, with other nations pyramiding money and credit on top of British sterling, while the United States, though still on a gold-coin standard, was ready to help Britain avoid suffering the consequences of abandoning the discipline of the classical gold standard.

Federal Reserve Chairman Jerome Powell gave the market exactly what it wanted on Wednesday–although that might not be exactly what the economy needs. The Dow Jones Industrial Average was down about 44 points ahead of the Fed announcement; and ended the day up by 380 points, surging as Powell’s press conference reassured investors that although the Fed was pivoting toward a tighter stance, it was not going to tighten too much.

Federal Reserve Chairman Jerome Powell gave the market exactly what it wanted on Wednesday–although that might not be exactly what the economy needs. The Dow Jones Industrial Average was down about 44 points ahead of the Fed announcement; and ended the day up by 380 points, surging as Powell’s press conference reassured investors that although the Fed was pivoting toward a tighter stance, it was not going to tighten too much. “We’re going to win in 2022,” Joe Biden promised the Democratic National Committee at its holiday party. “I wanna tell my Republican friends: Get ready, pal! You’re gonna [be] in for a problem!”

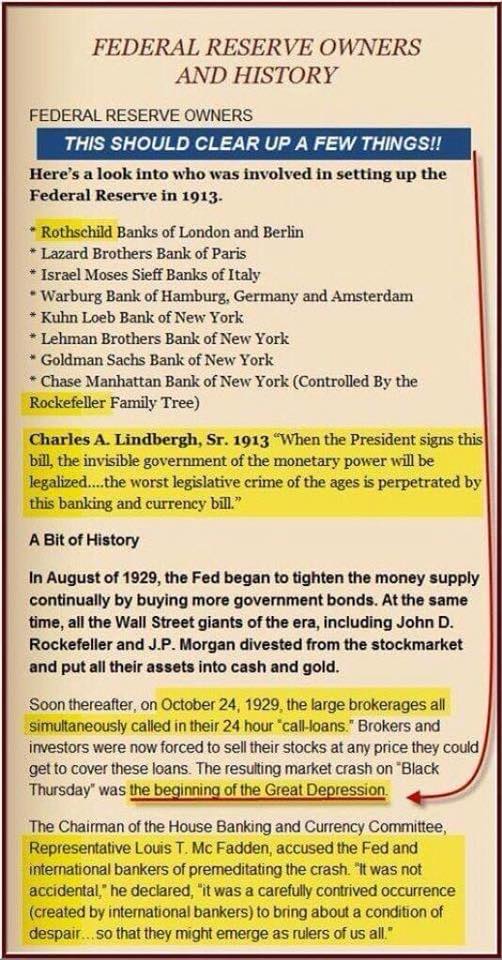

“We’re going to win in 2022,” Joe Biden promised the Democratic National Committee at its holiday party. “I wanna tell my Republican friends: Get ready, pal! You’re gonna [be] in for a problem!” We’re told by experts that the Fed is our number one inflation fighter, our protector against economic meltdown. Certainly, any person who cares about our country would accord it only the highest respect. But Preston Mathews wants to destroy the Fed. And he’s apparently surrendered everything — including the woman he loves — to do so. Who is this renegade who wishes to bring back the dark days of despair, as his critics charge? He’s the Fed’s top gun, the lord of interest rates . . . the chairman of the Federal Reserve.

We’re told by experts that the Fed is our number one inflation fighter, our protector against economic meltdown. Certainly, any person who cares about our country would accord it only the highest respect. But Preston Mathews wants to destroy the Fed. And he’s apparently surrendered everything — including the woman he loves — to do so. Who is this renegade who wishes to bring back the dark days of despair, as his critics charge? He’s the Fed’s top gun, the lord of interest rates . . . the chairman of the Federal Reserve.  What’s going on?

What’s going on?