Musk Says FEMA Spent $59 Million Last Week on Housing Illegal Immigrants in NYC Hotels

Down de Shittah – Das Whey it Go!

The U.S. Department of Government Efficiency (DOGE) has found that the Federal Emergency Management Agency (FEMA) spent $59 million last week on continuing to house illegal immigrants in luxury hotels in New York City, according to Elon Musk.

Florida Gov. Ron DeSantis, whose state has already launched a lawsuit against FEMA for reports of political discrimination, shared Musk’s post, saying this funding was “probably just scratching the surface of the mismanagement/corruption that has become so commonplace.”… (Continue to full article)

Thieves Set Their Sights On Eggs As Prices Skyrocket

Egg theft is becoming the new heist, as thieves set their sights on breakfast foods because of the massive spike in prices. The bird flu outbreak and authorities’ insistence on culling millions of birds are not only slowing the spread of the virus, but they are also jacking up the cost of eggs and poultry meat in the United States.

Egg theft is becoming the new heist, as thieves set their sights on breakfast foods because of the massive spike in prices. The bird flu outbreak and authorities’ insistence on culling millions of birds are not only slowing the spread of the virus, but they are also jacking up the cost of eggs and poultry meat in the United States.

A new surveillance video shows two suspects loading hundreds of dollars worth of eggs and other breakfast foods into a white van before fleeing the scene. The burglary happened at Luna Park Café in Seattle. The thieves stole one hundred thousand eggs, worth approximately $40,000, at Pete and Gerry’s Organic Eggs facility.

In just the last month, more than 20 million birds have been impacted by bird flu across the country. “Impacted by” means killed or looked at another bird that was determined to have avian influenza… (Continue to full article)

What About the Price of Beef?

In September 2023, we looked at the high price of beef and how big government has been bad for the American family budget. With stock indexes even higher, the situation for beef consumers is even worse.

In September 2023, we looked at the high price of beef and how big government has been bad for the American family budget. With stock indexes even higher, the situation for beef consumers is even worse.

In the US, the price of hamburger meat ended last year near a record high of $5.60 per pound. Just 5 years earlier – prior to covid – it was $3.88 per pound. From the early 1980s to 2000, hamburger meat averaged $1.50 per pound. That means that over that 40+-year period, hamburger meat is four times as expensive.

While that seems like a big increase – and it is – the rate of increase is only slightly higher than what the government claims has been the increase in consumer prices in general over the entire period as measured by their Consumer Price Index or CPI. So, beef has been a fairly accurate barometer of the impact of government and Federal Reserve policies undermining the household economy.

The US beef industry is in the midst of one of its largest two-year declines in beef production. This will have significant ramifications for everyone from consumers to cattle producers. Consumers will face higher retail prices than they did in 2023… (Continue to full article)

11 Random Facts That Show That America Is Rotting And Decaying Right In Front Of Our Eyes

11 Random Facts That Show That America Is Rotting And Decaying Right In Front Of Our Eyes

We are in far more trouble than most people realize. Fentanyl and other drugs are ravaging our cities, and homelessness, poverty and hunger are rapidly growing all around us. Meanwhile, our federal government, our state governments, and our local governments are drowning in debt, and economic conditions are steadily deteriorating.

Corruption is rampant, incompetence is seemingly everywhere, and the moral decay of our society is accelerating. Unfortunately, much of the population is completely oblivious to what is going on because they are deeply addicted to the electronic gadgets that they are constantly staring at. The following are 11 random facts that show that America is rotting right in front of our eyes…

The U.S. national debt was sitting at about 10 trillion dollars when Barack Obama first entered the White House. Today, it is sitting at 36.2 trillion dollars… (Continue to full article)

That Was the Week That Was: May 25, 2002

Just a few words from out of the PAST…

Fears continue to grow about a massive oil shortage – don’t bet on it – they’ll just raise the price – and we’ll get pumped once more. The U.S. stock markets took it in the shorts as Merrill got Lynched to the tune of one hundred (million) large ones for having allowed their brokers to lie, cheat and steal from their clients! Oops! – their bottom line just took in the butt. …. And we’re afraid that this is just the tip of the cigar iceberg! Watch out – Aetna might just gatcha!

Fears continue to grow about a massive oil shortage – don’t bet on it – they’ll just raise the price – and we’ll get pumped once more. The U.S. stock markets took it in the shorts as Merrill got Lynched to the tune of one hundred (million) large ones for having allowed their brokers to lie, cheat and steal from their clients! Oops! – their bottom line just took in the butt. …. And we’re afraid that this is just the tip of the cigar iceberg! Watch out – Aetna might just gatcha!

The U.S. dollar is going to get another face lift (oh goody – last time they gave each of our leaders new coiffs and makeovers) – new colorizations (call Ted Turner). This leads to the question – demonitization! Speculation abounds. We’ll keep our eyes on this one.

Nasdaq poised to smash post-9/11 lows, unleashing one of the worst selling panics since 1929!

Nasdaq poised to smash post-9/11 lows, unleashing one of the worst selling panics since 1929!

Argentina’s banking customers assets have been frozen by ‘the State’. Japan is in a financial spiral and foreign investments in U.S. Securities are down 75% from a year ago. U.S. investors paper (read Wall St.) investments dumped and gold rose to above $320.00 per ounce. It’s moving upward now – but there’s still time to take advantage of relatively low prices – before the economic collapse of Alan Greenscam. Call Kettle Moraine (602-799-8214) for your personal financial consultation if you feel the time is here to secure your bankroll (or what little may be left of it.) Don’t wait for the saved by the bell phone call from your Broker – for it’s you who will be broker!

So interesting to go back in time – MAN – and you didn’t buy gold THEN? – DAMN – it’s TEN X as much Now!!! (Continue to full article)

At its September 2024 meeting, the Fed’s FOMC cut the target federal funds rate by a historically large 50 basis points and then justified this cut on the grounds that “The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

At its September 2024 meeting, the Fed’s FOMC cut the target federal funds rate by a historically large 50 basis points and then justified this cut on the grounds that “The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.” The penny phenomenon is good example of what the federal government — and, specifically, the Federal Reserve — has done to our money.

The penny phenomenon is good example of what the federal government — and, specifically, the Federal Reserve — has done to our money.

Egg theft is becoming the new heist, as thieves set their sights on breakfast foods because of the massive spike in prices. The bird flu outbreak and authorities’ insistence on culling millions of birds are not only slowing the spread of the virus, but they are also jacking up the cost of eggs and poultry meat in the United States.

Egg theft is becoming the new heist, as thieves set their sights on breakfast foods because of the massive spike in prices. The bird flu outbreak and authorities’ insistence on culling millions of birds are not only slowing the spread of the virus, but they are also jacking up the cost of eggs and poultry meat in the United States. In September 2023, we looked at the high price of beef and how big government has been bad for the American family budget. With stock indexes even higher, the situation for beef consumers is even worse.

In September 2023, we looked at the high price of beef and how big government has been bad for the American family budget. With stock indexes even higher, the situation for beef consumers is even worse. 11 Random Facts That Show That America Is Rotting And Decaying Right In Front Of Our Eyes

11 Random Facts That Show That America Is Rotting And Decaying Right In Front Of Our Eyes Fears continue to grow about a massive oil shortage – don’t bet on it – they’ll just raise the price – and we’ll get pumped once more. The U.S. stock markets took it in the shorts as Merrill got Lynched to the tune of one hundred (million) large ones for having allowed their brokers to lie, cheat and steal from their clients! Oops! – their

Fears continue to grow about a massive oil shortage – don’t bet on it – they’ll just raise the price – and we’ll get pumped once more. The U.S. stock markets took it in the shorts as Merrill got Lynched to the tune of one hundred (million) large ones for having allowed their brokers to lie, cheat and steal from their clients! Oops! – their  Nasdaq poised to smash post-9/11 lows, unleashing one of the worst selling panics since 1929!

Nasdaq poised to smash post-9/11 lows, unleashing one of the worst selling panics since 1929!

Cigna Group plans to make changes to help lower out-of-pocket cost of prescription drugs, the company said on Wednesday, as it responds to criticism over the role of its pharmacy benefit manager in driving up drug costs.

Cigna Group plans to make changes to help lower out-of-pocket cost of prescription drugs, the company said on Wednesday, as it responds to criticism over the role of its pharmacy benefit manager in driving up drug costs. Most Americans realize that the federal government is drowning in debt and that inflation is out of control. But very few Americans can coherently explain where money comes from or how our financial system actually works. For decades, bankers that we do not elect have controlled America’s currency, have run our economy into the ground, and have driven the U.S. government to the brink of bankruptcy. The Federal Reserve is an institution that was designed to drain wealth from U.S. taxpayers and transfer it to the global elite.

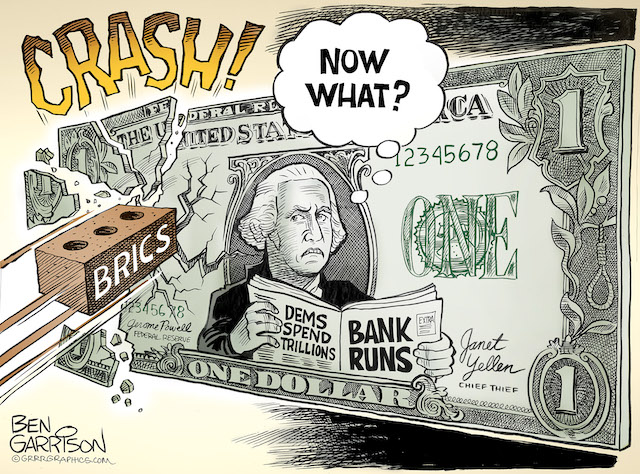

Most Americans realize that the federal government is drowning in debt and that inflation is out of control. But very few Americans can coherently explain where money comes from or how our financial system actually works. For decades, bankers that we do not elect have controlled America’s currency, have run our economy into the ground, and have driven the U.S. government to the brink of bankruptcy. The Federal Reserve is an institution that was designed to drain wealth from U.S. taxpayers and transfer it to the global elite.